How to Login:

Step 1: If you are a new user to the Eppicard site, you must create a User ID.

Your User ID must consist of 6 to 8 alphanumeric characters (letters and/or numbers).

Your Password must be 8 to 16 alphanumeric characters (letters and numbers) and include all of the following:

- One or more uppercase letters

- One or more lowercase letters

- One or more numbers

- Not be the same password you have used for this account in the past

Be sure to have all the information that you will need to create an ID

- Your Eppicard number

- You Eppicard CVV

- Your Social Security number

- Your birthday

- An email address

Step 2: Go to the Eppicard website and type your User ID into the box on the left.

If you have forgotten your User ID, go to the Eppicard Forgot User ID page. You will be required to enter your Eppicard number and the CVV.

How to Check Your Balance

- Any In-network ATM a $0.75 fee will be charged for balance inquiries.

- Sign up for a free low balance alert via email, phone or text message.

- Call 1-877-246-1311 for 2 free customer service calls that are allowed each month to check your balance and hear transaction history, after 2 a fee of $0.35 will be charged for each call.

- Sign up on Eppicard.com to have unlimited access to balance inquiries and account transactions.

How to Contact Customer Service

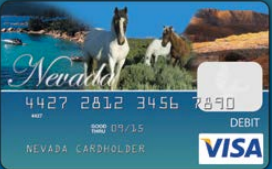

Take advantage of the 24 hour, 7 days a week New Hampshire Child Support Card customer service line. Customer service representatives are available to:

• Check your balance

• Select or change your Personal Identification Number (PIN)

• Review transaction history

• Ask questions about card use

• Dispute a transaction

• Report lost or stolen cards

• Setup phone deposit notification and/or low balance alerts

Eppicard Fees and Charges

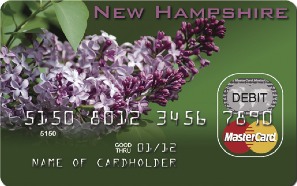

All the fees and charges associated with a Citizen Bank debit Mastercard, as stated in the terms of use.

- You are allowed two (2) free ATM cash withdrawals each month only if conducted at Citizen Bank ATMs. A fee of $1.75 will be assessed for each ATM cash withdrawal after that, and at any other ATM locations. A fee of $1.75 will be assessed for each ATM withdrawal conducted outside of the United States. An additional fee equal to 3% of the amount of the transaction will be charged for each international ATM withdrawal transaction.

- A fee of $0.75 is assessed for each balance inquiry or ATM denial for insufficient funds. A denial occurs when there are not sufficient funds available to cover your cash withdrawal

request. - If you conduct a transaction at an ATM other than Citizens Bank, the owner of the ATM may impose an additional fee called a “surcharge.” Read the screen message carefully for

information related to surcharges before you press “Enter.” You will have the option to cancel the transaction and go to another ATM. Merchant Point of Sale. There is no charge for a purchase at merchant locations when performing signature-based transactions. - There is a $0.30 fee for purchase using your PIN. A fee of $0.30 is charged to your Card account for a purchase with cash back at merchant locations. Cash withdrawals at Bank Tellers.

- Your Card account will be charged $2.00 for each cash withdrawal at any MasterCard Member Bank teller window. After receipt of your initial Card, you may receive one free Card replacement each 12-month period.

- A $5.00 fee will be charged for each additional Card replacement; plus an additional $15.00 if you request that the replacement Card be sent express two day delivery (business days only) rather than by regular mail.

- Additional services: There is no fee to sign up for deposit notification and/or low balance alert via email, phone or text message. If you sign up for instant mobile balance request, your Card account will be charged $0.10 for each notification.

- You are allowed two (2) free calls to Customer Service Interactive Voice Response (IVR) each month to check your balance or hear your transaction history. After two (2) free calls, there is a charge of $0.35 for each call.