If you’re looking for information on the third stimulus payment, we’re here to help. We will provide you with everything you need to know about your third stimulus check including how much you’ll receive and when you can expect to receive it.

In this article, we will cover:

- Information on the Third Stimulus Bill Passed

- Stimulus Guidelines and Eligibility

- How to Calculate your Stimulus Payment

- Stimulus Payment Update and Schedule

- IRS Get My Payment App and Tracker

- Stimulus Debit Card Help

Third Stimulus Bill Passed

On March 11th, President Biden signed the third stimulus bill into law, providing financial relief to millions of Americans. The American Rescue Plan Act of 2021 provides $1,400 Economic Impact Payments to eligible individuals.

In addition to $1,400 stimulus checks, the American Rescue Plan will immediately reduce childhood poverty, extend the current $300 unemployment benefit increase, help Americans stay in their homes, increase SNAP benefits by 15% until September 2021, lower health insurance premiums, increase the child and earned income tax credit, increase funding to the TANF cash assistance program, expand child care assistance, and provide additional tax credits to help cut child care costs.

To learn more about the American Rescue Plan, click here to read the complete Fact Sheet.

Stimulus Check for 2021

The Stimulus Check for 2021 in the American Rescue Plan serves as a bridge to economic recovery for working families. The IRS started sending out the $1,400 stimulus checks out on March 12, 2021. Over 85% of American households can expect to receive the stimulus check for 2021.

For the first time, adult dependents will be eligible to receive an Economic Impact Payment through the third stimulus bill. A lower or middle-income family of four can expect to receive a third stimulus check for $5,600.

For information on your $1,400 stimulus payment including eligibility guidelines and help calculating your payment, continue reading below.

Stimulus Guidelines and Eligibility

The third stimulus bill authorizes another round of $1,400 stimulus checks to be sent to eligible individuals or $2,800 for eligible couples, plus an additional $1,400 for each dependent. Like the first and second stimulus checks, your income must meet a certain threshold in order to meet the qualify for the third stimulus payment.

The IRS will use your most recent tax return information to determine if you or your household is eligible to receive the third stimulus package. That means if you haven’t filed your 2020 tax return, your 2019 tax return will be used to determine if your stimulus check eligibility.

To help, we’ve outlined the stimulus guidelines and income eligibility standards for you below. All stimulus guidelines and income limits for the third stimulus check are based on your Adjusted Gross Income (AGI).

| Eligible Income for the $1,400 Third Stimulus Check | Not eligible for a Third Stimulus Check | |

| Single taxpayer | Less than $75,000 per year | $100,000 or more per year |

| Head of household | Less than $112,500 per year | $150,000 or more per year |

| Married couples filing jointly | Less than $150,000 per year | $200,000 or more per year |

If your income is more than the eligible amount (listed in column 1), but less than the not eligible amount (listed in column 2), then you will receive a reduced stimulus payment.

Stimulus Guidelines by Filing Status

- If you’re a single filer, your payment is reduced if your income is above $75,000 on your last tax return.

- For married couples filing jointly, your third stimulus check will be reduced if your annual gross household income is more than $150,000.

- If you file as head of household, the stimulus payment reduction begins when your adjusted gross income exceeds $112,500 per year.

If you have filed your 2020 Tax Return, then your 2020 adjusted gross income will be used to determine your eligiblity for the third stimulus check.

Stimulus Payment Calculator

If you want to know how much you can expect to receive from the third stimulus package, we can help. Use the information provided below to calculate your third stimulus payment.

How to Calculate your Third Stimulus Check

To calculate your third stimulus check, you will need the most recent Tax Return you filed with the IRS – either 2019 or 2020 Tax Return. Once you have your Tax Return, you will need to three pieces of information to calculate your third stimulus check.

You will need:

- Your Tax Filing Status – Single, Married, or Head of Household

- Number of Dependents on your Tax Return (Children under 18 and Adult Dependents)

- Total Adjusted Gross Income (AGI) on your Tax Return

Once you have gathered this information, you can determine how much you will receive from the the third stimulus package. To calculate the exact amount you will receive on your third stimulus check, use the Stimulus Check Calculator Tool.

Stimulus Payment Update and Schedule

The IRS started sending out the third-round of the Economic Impact Payment beginning on March 12, 2021.

There are three options available for receiving your third stimulus payment.

They include:

- Direct Deposit (see details about Direct Deposit Dates below).

- Paper Check via USPS

- Stimulus Debit Card (EIP Debit Card)

Below we have provided the possible timeline for when you can expect to receive your third Economic Impact Payment.

| Process Remaining for Stimulus Bill | Actual and Future Possible Dates |

| House of Representatives Passes Bill | February 27, 2021 |

| Senate Passes Stimulus Bill | March 6, 2021 |

| House of Representatives Votes on Senate Bill | March 9, 2021 |

| Stimulus bill signed into law by President Biden | Thursday, March 11 |

| First direct deposit check sent by IRS | March 12 (pending), March 17 (official) |

| First paper checks sent by IRS | Week of March 22 |

| First EIP Prepaid Debit Card sent by IRS | Week of March 29 |

| IRS deadline to finish sending checks | Dec. 31, 2021 (mandated by the bill) |

| Last date to receive a check | January 2022 (if checks sent late December) |

| Claims for missing stimulus money open | 2021 tax season likely (in 2022) |

IRS Stimulus Direct Deposit Dates

If you are receiving your third stimulus payment via direct deposit, here’s when you can expect to receive it.

| First Round of Direct Deposits for the Third Stimulus Payment |

| Friday, March 12th, 2021 |

| Second Round of Direct Deposits for the Third Stimulus Payment |

| Monday – Wednesday |

| March 15th – 17th, 2021 |

| Third Round of Direct Deposits for the Third Stimulus Payment |

| Friday, March 19th, 2021 |

| Note: These are for Direct Deposits only, not paper checks or EIP Debit Cards |

If you did not see a deposit in your bank account on Friday, March 12th, you may be scheduled for round two or three of direct deposits.

If you want to know the exact date when your stimulus payment will be sent, we highly recommend using the IRS Get My Payment App. For help, follow the steps provided below on how to use the IRS Stimulus Payment Tracker.

IRS Get My Payment App and Payment Tracker

To find out when you will receive your stimulus check, the IRS has tool that allows you to track your Third Stimulus Payment. The IRS “Get My Payment” App is an online portal that allows you to track your 2021 Economic Impact Payment.

This is an update version of the Stimulus Payment Tracking Tool used during the first and second round of stimulus checks sent to Americans through the Economic Impact Payment Program. If you did not receive your first or second stimulus payment, you can claim your 2020 Recovery Rebate Credit here.

To track your Third Stimulus Payment through the IRS Get My Payment App, you will need to provide some of your personal information. This information should match up with the information provided on your most-recent Tax Return.

You will be asked to provide:

- Social Security Number (SSN) or Individual Tax ID Number (ITIN)

- Date of Birth

- Street Address on your Tax Return

- 5-digit ZIP or Postal Code

If you are married and file a joint tax return, either partner can access the IRS Get My Payment App by providing their information. Please note that you may be asked to verify your identity by answering a few security questions.

How to Login the IRS Get My Payment App

For help on how to use and login the IRS Get My Payment App to track your third stimulus check, follow the instructions provided below.

- Visit the IRS website at www.irs.gov.

- Click the “Get Coronavirus Tax Relief” button on the left-side of the page.

- Select the “Get My Payment Tool” link in the third paragraph on the page.

- Click the blue “Get My Payment” button on the page.

- Select “OK” on the next page.

- Enter your Personal Information from your recent Tax Return.

- Click the blue “Continue” button.

If you successfully entered all your information, you will now be displayed with your Payment Status for the third stimulus payment.

IRS Get My Payment App Errors

If the information you submitted does not match the IRS’s records, you only have two more chances to try again before getting locked out. The IRS Get My Payment App only allows three login attempts in a 24-hour period before you are locked out of the system.

If you are locked out of the IRS Payment Tracking Tool, you will receive a message that says, “Please Try Again Later.” In addition, you will also be locked out if you have tried to access the Get My Payment Tool five times within a 24-hour period.

The best thing to do if you are locked out and the Get My Payment Tool is not working, is to wait 24 hours and try to access your payment status again. For additional help using the IRS Get My Payment App or questions about your third stimulus check, please contact the IRS Customer Service phone number.

IRS Get My Payment Phone Number

For help using the IRS Online Payment Tool to track your third stimulus check or payment, please contact the IRS Customer Service or IRS Get My Payment Phone Number.

The IRS Customer Service Phone Number has representatives available to assist you Monday through Friday from 7 a.m. to 7 p.m. Eastern Standard Time. The IRS Customer Service Toll-Free Number is 800-829-1040.

To speak with a live person at the IRS about your Economic Impact Payment or third stimulus check, please call the IRS Get My Payment Phone Number at 800-919-9835.

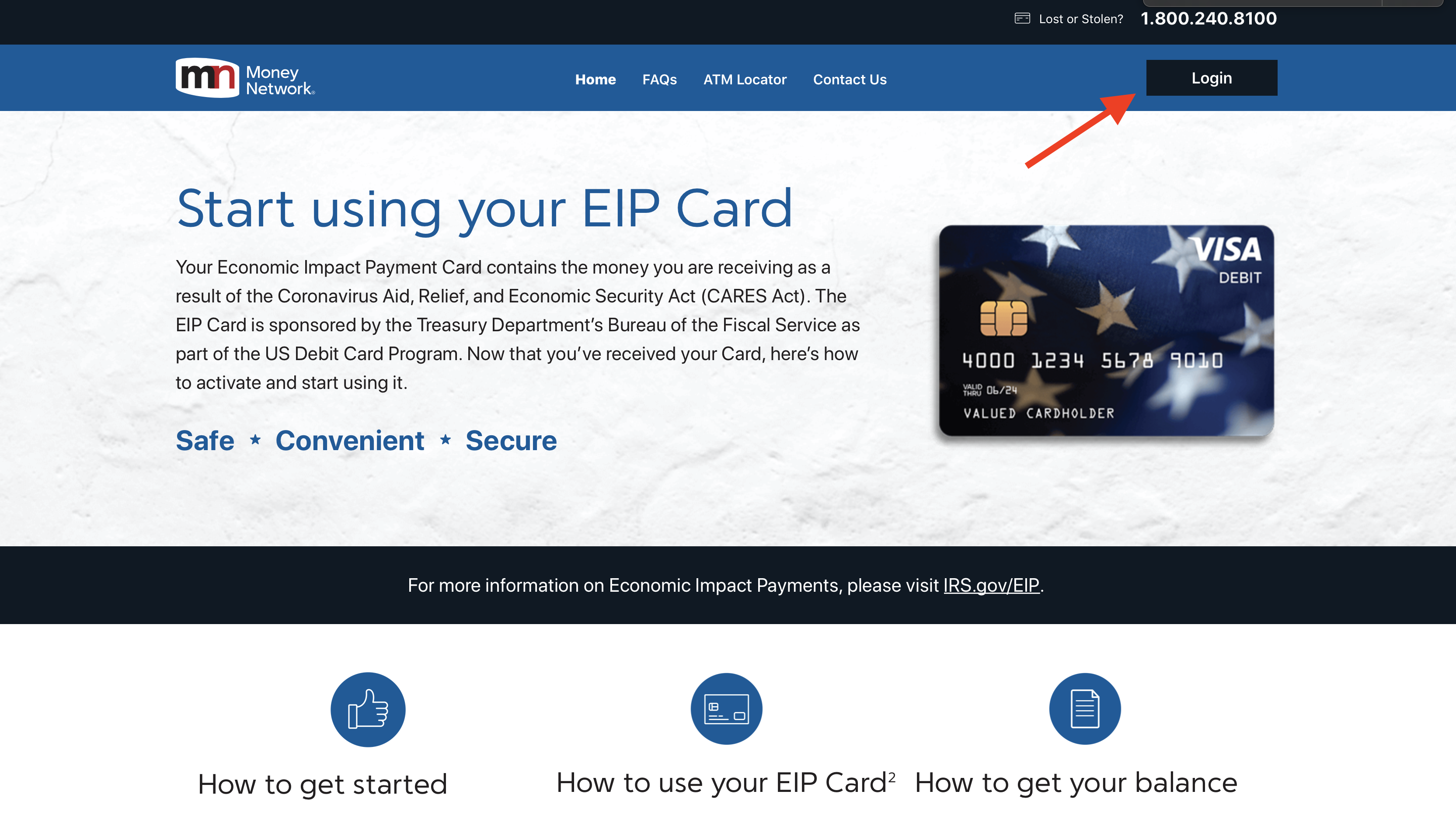

Stimulus Debit Card Help

The last option for receiving your third stimulus payment is through the Stimulus Debit Card, also known as the Economic Impact Payment (EIP) Card. If the IRS sent your first or second stimulus payment as an EIP Card, then you can expect to receive your third stimulus check the same way.

If you have an existing EIP Card, your third stimulus payment WILL NOT be added to a previous EIP Card. A brand-new prepaid Stimulus Debit Card will be sent to you in the mail for your third Economic Impact Payment.

Your EIP will arrive loaded with the calculated total for your third stimulus check payment. The IRS stated that they will not add money to any previous Stimulus Debit Card you may have.

For help with your EIP Debit Card for your third stimulus payment, including how to check your balance, what to do if you haven’t received your card and more, check out our EIP Debit Card Guide.

Third Stimulus Check Questions

We hope this article on the third stimulus check through the American Rescue Plan Act of 2021 was helpful to you. If you need additional help or assistance navigating your third stimulus payment or a previous Economic Impact Relief payment, let us know in the comments below. We are happy to provide help and guidance!

Check out our other Stimulus Debit Card articles below:

- Stimulus Debit Card Envelope: What does it look like?

- What to Know about the Stimulus Debit Card

- EIP Card Balance and Login